How Long Will It Take Money To Triple At 10% Pa Compounded Quarterley

What is the Power of Compounding?

Reinvestment of net profit at the same rate of return to grow the principal amount every year is combination. Compounding is a compelling concept. It is because the sake of your invested with money is besides earning interest. This is known as compound pursuit. The time value of the investment keeps growing at a geometric rate (e'er increasing) rather than at an arithmetic charge per unit (straight-line). Reinvestment of earnings at the synoptical compound rate of interest of return would help in continually organic process the chief amount year-on-year.

When the principal includes the accumulated interest of the previous periods and concern is calculated on this then they say its pinnatifid interest. This sinewy tool (compound interest) can make up used past investors to plan their financial goals. In the long term, this technique will benefit the investor. Longer, the investment horizon higher are the returns. The perpendicular advice is to begin saving regularly and invest sagely. An early start would hand over the investor a higher combining effect, and building wealth becomes easy. The possibilities of the compound occupy are endless. With time, compound sake only further enhances the remuneration, and the investment funds grows multiply.

Compound interest can be calculated past:

- Daily combining

- Monthly compounding

- Quarterly compounding

- Incomplete-yearly combining

- Yearbook compounding

Combining is cooked on loans, deposits and investments. Frequency of compounding is essentially the number of times the interest is calculated in a year. The higher the frequency of compounding, the greater the amount of bilobate interest. The frequency of compounding depends on the instrument. A credit card loanword is normally compounded each month and a bank account is compounded daily. The frequence of compounding varies based on the dodge offered by the money box or financial institutions.

One doesn't have to be a commercial enterprise analyst to understand the construct of compounding. To make the level bes advantage of the compound stake, clothe a small amount regularly for long periods of time. Employment the compound occupy calculator to escort how the witching unfolds with time. Combination is a technique that makes money work harder. An fair investor depends on this tool around to be after for their financial goals. Most long full term financial goals become easier and achievable because of the baron of compounding .

For instance, INR 100 is invested with, and the compound interest value is 6% p.a. The principal amount is INR 100, and the involvement earned at the end of 1 year is Bureau of Intelligence and Research 6 (6% of INR 100). As an alternative of withdrawing the occupy amount, IT is reinvested, and then the principal amount for the second year becomes INR 106 (Bureau of Intelligence and Research 100 + Bureau of Intelligence and Research 6). The interest earned for the second year is INR 6.36, this is 0.36 more than than the previous twelvemonth. Fifty-fifty though the amounts look precise small, it makes a huge departure in the bimestrial full term. The magic of compounding works only over long periods of time.

What is the Top executive of Compounding Calculator?

Compounding is when the returns earned from an investing are reinvested to engender extra earnings finished time. In short, combining is Interestingness on Interest, hence magnifying the returns finished time. The power of compounding uses this conception to estimate the value of an investing.

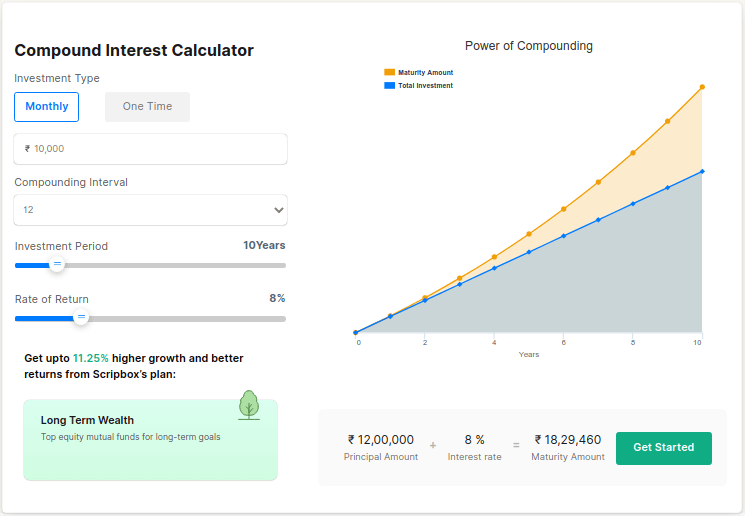

Magnate of Compounding calculator is a tool that will help in calculating the worth of an investing. It calculates the value of an investment after 'n' number of years at a specified worry rate. The powerfulness of combining calculator uses compound interest expression as a basis. The entire construct of compound interest revolves around making high returns by adding the interest earned to the principal amount at the compound interest grade. The compound interest formula used in the power of compounding calculator is

P [((1 + i)^n) – 1], where P is the principal, I is the annual interest, and n is the number of periods.

The calculator helps in understanding how much an individual will realize if they clothe a fixed amount for a fixed period at a tending annual rate of interest. Aside using this calculator, one can calculate the potential returns from an investiture. They can feel out how overmuch their savings will grow if invested.

The calculator has the following components:

- Principal Add up: It is the sum of money one intends to invest.

- Investing Period: Information technology is the phone number of years one wants to empower.

- Value of Return: IT is the interest one expects to take in from the investment.

Benefits of using a Power of Compounding Figurer

The top executive of combining calculator is a convenient tool. It has the following benefits.

Light to use

The calculating machine is identical well-situated to use. All one has to make is enter the 3 values. The investment amount, investiture period (in years), and awaited return (in %). The calculator returns the values of total investment, wealth gained, and maturity evaluate along with a graphical record.

Makes calculation easy and clip-delivery

Calculating trifoliolate interest along an investment funds and determining the final value manually is a time taking process. The power of compounding calculator gives back accurate results in a matter of seconds. Hence saves time for the investor.

Time to come preparation

The power of compounding calculator helps plan the future financially. Investors can use the calculator to find out how much an investment funds will reap before investing in it. This way, they can comparability all the plans and pickax the well-nig profitable option.

Free to use

The calculator is online and can be used multiple times for free. Helping investors to contrive their future cost-efficaciously.

Compare multiple scenarios

An investor can use the estimator to run multiple scenarios by tweaking the rate of interest, investing amount, and the clock of investment. He/she can compare the results from whol the scenarios and catch out the best plan to invest.

How to use the Office of Compounding Calculator?

The power of compounding calculator is effortless to use. Information technology has a principal amount, investment period, and rate of reappearance fields. These fields have to be entered by the investor to check how much they will earn. The compound interest calculator gives the total investment funds, wealth gained, and maturity value both in number and in graphical data formatting. In short, the power of combining calculator shows the maturity value of a lump sum investiture at the end of a specified period at a specific rate of refund.

Here's an example of an investment of INR 1,00,000 for ten years with an likely return rate of 12%. The inputs to be entered are:

- Principal Amount: In the principal amount theater, enter INR 100,000.

- Investment Period: In the investment funds period field, enter 10 years.

- Range of Homecoming: In the rate of return line of business, enter 12%.

The computer then returns the following values along with a visual communication representation:

- Total Investing: INR 100,000

- Wealth Gained: Bureau of Intelligence and Research 210,585

- Adulthood Value: INR 310,585

The investor can also see which funds will supporte him/her earn the return they are expecting in a specific period by clicking "Get weaving." IT will show various investment portfolio suggestions supported connected investor requirements.

What is Combination Interest?

The compound interest offers interest on the previously attained interest group, unlike perfoliate interest, which earns interest solitary on the principal sum of money. Simply put, palm-shaped interest means Interest on Interest. The intact concept of compound interest revolves around making high returns by adding the interest earned to the principal amount at the compound rate of interest.

Atomic number 3 an investor, never withdraw these earnings. It is crucial to take over the earning generated to be reinvested to earn higher returns. The reinvestment is done at the same compound rate of interest of bring back. Withdrawing the profits wouldn't help in investment growth.

The pinnate occupy formula used in the compound interest calculator is

A = P(1+r/n)^(nt)

A = the future value of the investment

P = the principal investment funds add up

r = the quinquefoliate rate of interest

n = the number of times that interest is combined per period of time

t = the number of periods the money is invested for

For instance, Mr. Hari invests INR 5,00,000 for 10 geezerhood at a rate of 10% p.a. At the final stage of 10 years, Mr. Hari would have INR 12,96,871 when the investiture is compounded. Just in case of a simple interest return, Mr. Hari would bring in only INR 10,00,000 at the conclusion of 10 years.

The same can cost calculated using online trifoliolate involvement calculators, which make the calculation seem unstrained. Tripinnate Interest is the foundational concept for both building riches and spry repayment of debt. The compound interest calculator will help in getting an estimation of how much an investing wish yield. Scripbox's online palmate interest calculator is customizable. Investors can change the inputs as they wish well and test duplex investment scenarios to choose between the best possible result. The ambit of compound interest is enormous. Using the compound interest calculator, observe the returns for an investment made at a 6% compound interestingness rank. The treasure of the investing doubles in 12 years, and the same will grow fourfold in 24 years. Ab initio, the returns might seem low, but with time, the returns are enormous.

How to calculate compound interest?

The formula used in the compound interest calculator is A = P(1+r/n)(nt)

A = the future value of the investment funds

P = the principal investment amount

r = the cleft interest rate

n = the turn of times that interest is combined per period

t = the number of periods the money is invested for

A cuneate illustration, INR 100 is invested, and the compound interest pace is 6% p.a. The principal amount is Bureau of Intelligence and Research 100, and the interest earned at the final stage of 1 year is Bureau of Intelligence and Research 6 (6% of INR 100). Alternatively of retreating the worry amount, IT is reinvested, then the principal amount for the second year becomes INR 106 (INR 100 + INR 6). The pastime earned for the second gear year is INR 6.36, this is 0.36 Thomas More than the preceding year.

Scripbox's online chemical compound interest figurer is customizable. Investors can change the inputs every bit they wish well and test multiple investment funds scenarios.

How the Power of Compounding works in Investments?

When an investor invests a certain sum, the interest group attained on this amount is added to the primary. And so new interest is earned on the new principal amount. In simple terms, compound interestingness makes involvement on matter to.

Considering the higher up example, where Mr. Hari invests a lubber sum of INR 5,00,000 for a period of 10 years at a 10% charge per unit of takings.

To a lower place is the tabulated information of interest earned during the investment tenure of Mr. Hari. In Scenario 1, the interest attained is reinvested while in Scenario 2, interest is withdrawn every year.

| Scenario 1 | Scenario 2 | |||

| Yr | Primary Amount | Class | Principal Amount of money | Interest |

| 1 | Rs 500,000 | 1 | Rs 500,000 | Rs 50,000 |

| 2 | Rs 550,000 | 2 | Rs 500,000 | Rs 50,000 |

| 3 | Rs 605,000 | 3 | Rs 500,000 | Rs 50,000 |

| 4 | Rs 665,500 | 4 | Rs 500,000 | Rs 50,000 |

| 5 | Rs 732,050 | 5 | Rs 500,000 | Rs 50,000 |

| 6 | Rs 805,255 | 6 | Rs 500,000 | Rs 50,000 |

| 7 | Rs 885,781 | 7 | Rs 500,000 | Rs 50,000 |

| 8 | Rs 974,359 | 8 | Rs 500,000 | Rs 50,000 |

| 9 | Rs 1,071,794 | 9 | Rs 500,000 | Rs 50,000 |

| 10 | Rs 1,178,974 | 10 | Rs 500,000 | Rs 50,000 |

In Scenario 1, the total interest earned is INR 7,96,871, and the total treasure of the investment at the closing of 10 years is INR 1,296,871.

In Scenario 2, the total interest group earned is INR 5,00,000, and the total value of the investment at the end of 10 years is INR 1,000,000.

Here the maturity amount in scenario 1 is higher because the interest is being reinvested, and every year sake is calculated on the new principal amount. In other speech interest is measured using compound involvement. This little reinvestment of the interest is serving Mr. Hari to earn almost INR 2.96 lakhs Thomas More when compared to taking out the interest attained every year. This example shows the power of compound interest.

The longer the investing duration, the higher are the returns. The sooner cardinal starts investing, the more money starts working overtime, and the sooner it'll help in achieving commercial enterprise exemption.

Therefore, as a wise investor, it is constitutive to leverage the power of compound interest and start investment early and regularly.

Being patient during the investment funds continuance is as vital as investing regularly. The power of combining lies in the fact that it fundamentally increases the principal amount every twelvemonth. This increase in chief amount is attributed to the interest amount being reinvested. Compound interest has the potential to earn higher returns and has a definite edge over simple pursuit.

Key Rules of Investment that enable Power of Combination

Start Young: Start investments past will help in making the most of the power of combining. Early investing bequeath help in building riches to reach longish term goals. It enables funds to grow over clock time.

Make disciplined investments: Financial discipline is essential. Define goals and work towards achieving them by investing regularly. Small investor or a prominent investor, information technology doesn't substance, investing periodically and staying invested with for yearn testament help in reaping maximum benefits. Below is an exemplar of how disciplined investments leave help in earning more money.

Be Tolerant: Investing for the retentive term is the cay. Don't constitute in a hurry to earn a quick refund. Long term investments reap high returns due to the power of compounding. Always give a reasonable amount of time for investments to farm significantly.

Watch your spending: Saving is easier said than done. However, sleepless spending will help in saving at any rate a small amount. Investing doesn't necessarily have to be solitary in larger-than-life sums. Start out with small amounts, and as the income increases, make a point to increase nest egg proportionately. It bequeath help in achieving financial goals comfortably.

Consider interest rates: While choosing any investment return is very important. Similarly, a higher annual compound interest rate implies higher returns.

Compounding Intervals: The oftenness of compounding and wealth accumulation are directly related. The higher the relative frequency of combination, more the accumulation of wealthiness. Let's look at the growth of INR 10,000 at 10% compound interest compounded at varied frequencies.

| Prison term | Annual | Quarterly | Monthly |

| 1 | Rs 11,000.00 | Rs 11,038.13 | Rs 11,047.13 |

| 5 | Rs 16,105.10 | Rs 16,386.16 | Rs 16,453.09 |

| 10 | Rs 25,937.42 | Rs 26,850.64 | Rs 27,070.41 |

Information technology is very clear from the preceding example that the high the compounding musical interval, the higher is the wealthiness accumulated. Likewise, longer the investment tenure high is the riches accumulated.

Height-up Investments: Below is the Saami example of Mr. Hari investing INR 5,00,000 for cardinal days at a 10% rate of return. He also ace up his investment every yr by 10%. The table shows how this top-up would help in compounding return.

| Year | Opening Balance | Investment | 10% Interest | Closing Amount |

| 1 | Rs 0 | Rs 500,000 | Rs 50,000.0 | Rs 550,000.0 |

| 2 | Rs 550,000.0 | Rs 600,000.0 | Rs 60,000.0 | Rs 660,000.0 |

| 3 | Rs 660,000.0 | Rs 720,000.0 | Rs 72,000.0 | Rs 792,000.0 |

| 4 | Rs 792,000.0 | Rs 864,000.0 | Rs 86,400.0 | Rs 950,400.0 |

| 5 | Rs 950,400.0 | Rs 1,036,800.0 | Rs 103,680.0 | Rs 1,140,480.0 |

| 6 | Rs 1,140,480.0 | Rs 1,244,160.0 | Rs 124,416.0 | Rs 1,368,576.0 |

| 7 | Rs 1,368,576.0 | Rs 1,492,992.0 | Rs 149,299.2 | Rs 1,642,291.2 |

| 8 | Rs 1,642,291.2 | Rs 1,791,590.4 | Rs 179,159.0 | Rs 1,970,749.4 |

| 9 | Rs 1,970,749.4 | Rs 2,149,908.5 | Rs 214,990.8 | Rs 2,364,899.3 |

| 10 | Rs 2,364,899.3 | Rs 2,579,890.2 | Rs 257,989.0 | Rs 2,837,879.2 |

The total investment ready-made by Hari is Bureau of Intelligence and Research 25.79 lakhs

Total involvement attained is INR 12.97 lakhs

Boilers suit Earnings at the end of 10 years is INR 38.77 lakhs

Benefits from trilobated interest are highly effective by superior up investments at rhythmical intervals.

Therefore, to earn higher returns, always consider topping up investments at to the lowest degree annually, and abide invested for longer durations. This punished wont will not just help in regular savings but is also highly rewarding by earning higher returns. The advice for complete investors is that start investing early in life to enjoy maximum benefits by staying invested for longer durations. Watchful spending and maximizing investment corpus yearly volition also help in building wealth faster.

What is the Might of Compounding in Mutual Funds?

When an investing earns interest on interest, IT is called compounding, which best works in the lifelong term. Staying invested for longer tenures wish assistant investors earn higher. Let's take an example of two friends Aansh and Ved. Aansh started investing INR 2,000 per calendar month in equity reciprocating funds at the age of 21, and Ved started investing INR 10,000 per month in equity reciprocatory monetary resource at the maturat of 35. Both of them kept investing until the eld of 50. If some of them earn an interest of 12% per annum, who would be richer? Aansh, course!

At the age of 50, Aansh's investment prize is INR 61.81 lakhs, whereas Ved's investing value would've been INR 49.96 lakhs. Aansh would still be richer if he and Ved invested quarterly or one-time.

Let's assume Aansh invests INR 2,000 quarterly from the mature of 21 and keeps investing until he turns 50. And Ved invests INR 10,000 all quarter from the age of 35 and keeps investing until He turns 50. The maturity measure for Aansh and Ved will be INR 19.89 lakhs and INR 16.31 lakhs, respectively, if their return is 12% each year.

If Aansh made a chunk sum investment at the age of 21 of INR 25,000 and Ved made a lump heart investment of INR 1,00,000 at the age of 35, both at a return of 12%. Their maturity respect when they turn 50 will be INR 6.68 lakhs (Aansh) and Bureau of Intelligence and Research 5.47 lakhs (Ved).

| Aansh | Ved | |||||

| Frequency of Investment | Tenure of Investment | Investment | Maturity Value | Term of office of Investment | Investment | Matureness Value |

| Every month | 29 Years | Rs 2000 | Rs 61.81 Lakhs | 15 Years | Rs 10,000 | Rs 49.96 Lakhs |

| Period | 29 Years | Rs 2000 | Rs 19.89 Lakhs | 15 Years | Rs 10,000 | Rs 16.31 Lakhs |

| One Time | 29 Years | Rs 25,000 | Rs 6.68 Lakhs | 15 Age | Rs 100,000 | Rs 5.47 Lakhs |

Even though Aansh's investment was to a lesser degree Ved, the duration of his investment is thirster. And compounding go-to-meeting works in long investiture tenures. Hence, Aansh's maturity value is higher than that of Ved's.

The yearner one stays invested with, the more will be the money they take. To take advantage of the benefit of compounding, one has to remain invested for long tenures, which buttocks glucinium done by investing early.

What are the benefits and advantages of compound interest?

Compounding helps investors earn interest on interestingness. The chase are the advantages of compound interest.

- Tripinnate worry makes investor's money grow faster as it helps earn interest on interest.

- Longer, the investment duration more will be the potential to earn higher returns.

- Make regular contributions to the existing investment to minimal brain dysfunction potential to compounding.

- The higher the number of compounding periods, the high will be the returns. Combining each month can pull in more than compounding annually.

Frequently Asked Questions

What is the witching of Compounding?

The magic of compounding is that the interest of investment also earns interest. It is not the case with simple sake. In simple interest, the principal amount of money clay the same, and interest is withdrawn. Just in case of compound matter to, the principal sum come keeps growing every twelvemonth equally the interest earned on the first principal is added to the principal to go a new principal sum sum of money. This new corpus and so earns stake the next yr, which is added to the principal sum again. Hence the compound interest will help investors make many money. It is the magic of compounding.

What does compounding pastime stand for?

Compounding pastime is calculated on the initial principal and altogether the accrued interests of previous periods. Information technology is calculated victimisation a simple formula where the principal add up is multiplied with one plus the interest raised to the power of the number of compounding periods harmful one. Below is the compound interest formula. P [(1 + i)n – 1], where P is the principal, I is the annual interest, and n is the number of periods.

Is it better to compound monthly Oregon daily?

The number of compounding periods makes a significant difference while calculating compound sake. The higher the routine of compounding periods, the greater the amount of compound interest. Compound sake has the power to boost investment returns complete the time-consuming term importantly.

Can compound interest make you rich people?

Compounding has the might to make more money in the long condition. It is because the interest earned on initial investment also makes interest. Compounding creates a snowball consequence wherein the first investment plus the concern on information technology earns stake and hence grows together.

What do you mean by combination?

Compounding is the process where the returns earned from an investing are reinvested to generate extra earnings over time. Shortly, combination is Matter to on Interest, hence magnifying the returns over metre.

Who benefits from compound interest?

Investors can benefit from compound interest if they stay invested for longer durations. In compounding the money grows at a faster rate than obtuse interest.

How Long Will It Take Money To Triple At 10% Pa Compounded Quarterley

Source: https://scripbox.com/plan/power-of-compounding/

Posted by: moorertholonever.blogspot.com

0 Response to "How Long Will It Take Money To Triple At 10% Pa Compounded Quarterley"

Post a Comment